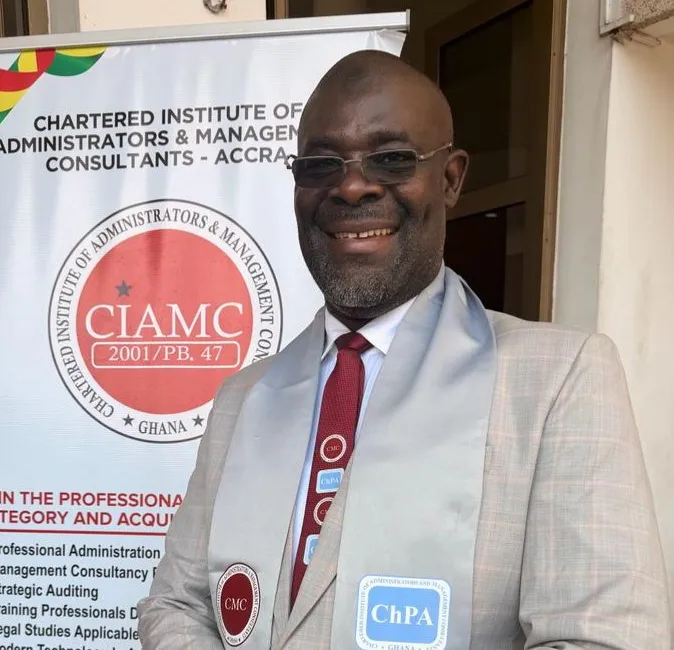

Former Auditor-General Daniel Yao Domelevo has accused some banks of turning a blind eye to suspicious financial transactions, thereby aiding corruption in the country’s public financial system.

Speaking on JoyNews’ Newsfile on Saturday, Mr. Domelevo said the seeming silence of banks in the face of questionable transactions makes them “complicit in the corruption chain.”

“When you go to withdraw GH¢100,000, the bank will ask for your Ghana Card, verify your details, and sometimes even call you back. Yet we are hearing that tens of millions move through the same banks without anyone raising questions. It either means fraudsters are inside the banks, or the banks are colluding,” he stressed.

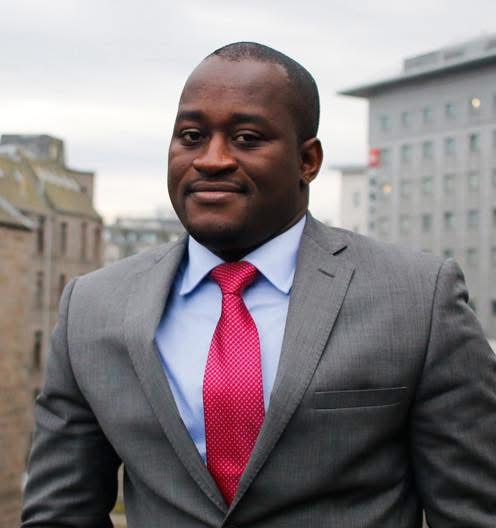

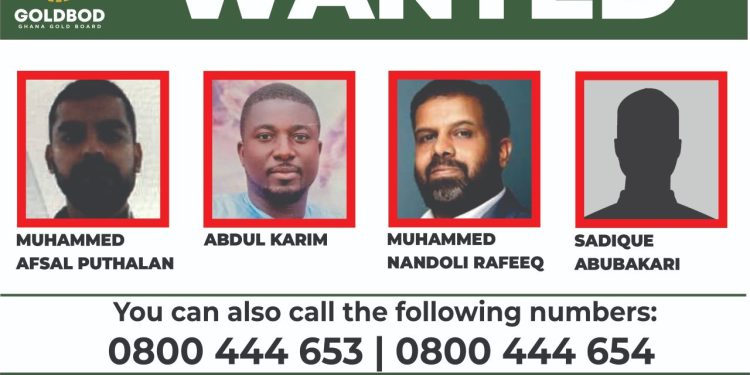

Mr. Domelevo’s commenThe Attorney-General and Minister for Justice, Dr. Dominic Ayine, recently disclosed that government has ordered JA Plants come on the heels of recent corruption revelations involving the District Road Improvement Programme (DRIP) and the National Food Buffer Stock Company.

t Pool Ghana Limited to refund $2 million after alleged irregularities were uncovered in the DRIP contract.

Dr. Ayine also revealed that investigators have traced over GH¢40.5 million in suspicious money transfers through Sawtina Enterprise, a company reportedly linked to former Buffer Stock CEO Abdul-Wahab Hannan.

According to the Attorney-General, these transactions were processed through several local bank accounts, raising questions about compliance and oversight within the financial sector.

Mr. Domelevo urged regulatory bodies such as the Bank of Ghana and the Financial Intelligence Centre (FIC) to enforce stricter anti-money laundering rules and hold banks accountable for failing to flag unusual transactions.

He argued that while state institutions are often blamed for corruption, the financial sector remains a silent enabler.

“We need to shake the banks,” he said firmly. “It is unacceptable that such transactions can pass through systems that are supposedly monitored 24/7. The banks cannot pretend to be asleep.”

Mr. Domelevo maintained that transparency and vigilance within Ghana’s banking system are critical if the nation hopes to reduce corruption and restore public confidence in financial governance.

Discover more from Hot Stories Ghana

Subscribe to get the latest posts sent to your email.