The Bank of Ghana (BoG) is stepping up efforts to attract skilled professionals from both within Ghana and abroad to strengthen the country’s non-interest banking and finance sector.

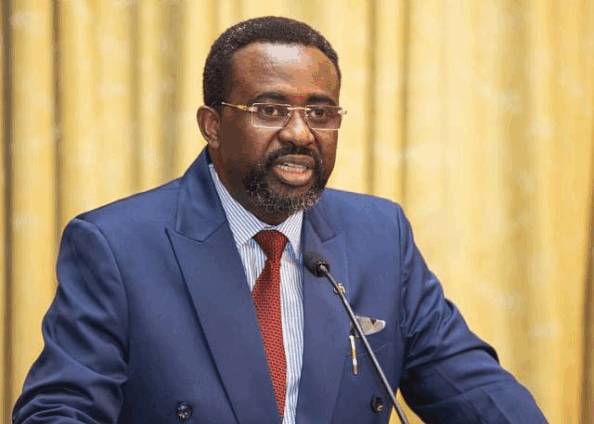

Speaking on behalf of the BoG Governor during a stakeholder forum in Accra, Acting Head of Banking Supervision, Ismail Adam, highlighted the sector’s potential to enhance financial inclusion and diversify the nation’s financial system.

“Non-interest banking is increasingly recognized worldwide as a tool to provide access to finance for underserved communities and small and medium enterprises,” Mr. Adam said. “Ghana can greatly benefit by leveraging the right expertise alongside supportive regulations.”

He emphasized the BoG’s commitment to creating an enabling regulatory framework that allows non-interest financial institutions to flourish. This includes capacity building and tapping into both local and international talent to strengthen the sector’s foundations.

The Director-General of the Securities and Exchange Commission (SEC), James Klutse Avedzi, also highlighted the value of strong collaboration between regulators and market players. He noted that a well-regulated and adequately resourced non-interest financial ecosystem can enhance investor confidence and contribute to the growth of Ghana’s capital markets.

“We are ready to work closely with the central bank to support the full development of non-interest banking and finance in Ghana,” Mr. Avedzi said.

The stakeholder engagement convened financial institutions, regulators, and other industry participants to review progress and explore strategies for unlocking further opportunities in this emerging sector.

Discover more from Hot Stories Ghana

Subscribe to get the latest posts sent to your email.