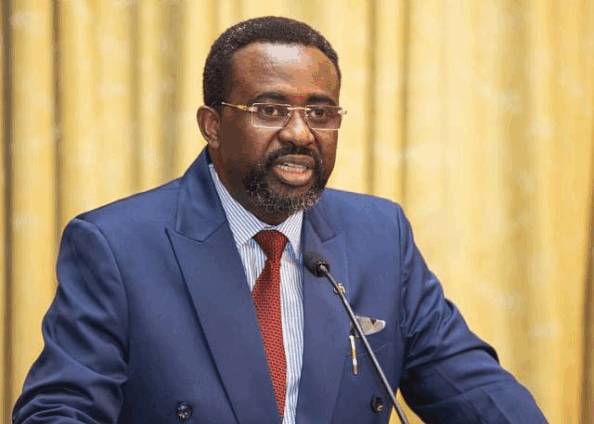

The Commissioner-General of the Ghana Revenue Authority (GRA), Anthony Kwasi Sarpong, has assured the business community that the government’s proposed Value Added Tax (VAT) reforms will bring significant relief to small and medium-sized enterprises (SMEs) when they take effect in 2026.

Speaking on Asempa FM’s Ekosii Sen programme, Mr. Sarpong revealed that the reforms, currently before Parliament, have been widely welcomed by business operators who have long called for a fairer, more flexible VAT structure. He expressed optimism that the legislative process would be completed before the end of the year to allow for implementation at the start of 2026.

According to him, the new VAT model directly responds to major concerns raised during stakeholder engagements, particularly the tax burden on small businesses.

Under the revised system, only businesses earning at least GH₵200,000 annually will be required to pay VAT, while the main VAT rate will apply only to enterprises with annual incomes of GH₵750,000 or more. The GRA says this tiered approach will protect smaller businesses while ensuring equity in tax contributions.

“We have completed the VAT reforms, and they are currently in Parliament awaiting approval,” Mr. Sarpong explained. “We hope Parliament will endorse them by the end of this year so that we can begin implementation early next year.”

He added that the business community is “very pleased” with the VAT proposals in the 2026 Budget because they address long-standing complaints about excessive tax pressure on micro and small enterprises.

Mr. Sarpong called for full cooperation from business associations, traders, and industry players to ensure a smooth rollout once the reforms become law, noting that the changes will strengthen tax compliance while stimulating business growth across the country.

Discover more from Hot Stories Ghana

Subscribe to get the latest posts sent to your email.