Ghana is taking bold steps to support struggling companies and protect jobs with the introduction of the Corporate Insolvency and Restructuring Act (CIRA), a new law designed to help businesses recover instead of collapsing.

Maame Samma Peprah, Acting Registrar of the Office of the Registrar of Companies (ORC), said the law marks a major shift in how the country handles financially distressed firms. She explained that instead of closing down, troubled companies can now restructure and return to profitability under professional guidance.

“Ghana is adopting a more forward-thinking approach to insolvency. The new law gives businesses a fair chance to recover while promoting responsible and transparent management,” she said during a stakeholder forum in Accra on October 8, 2025.

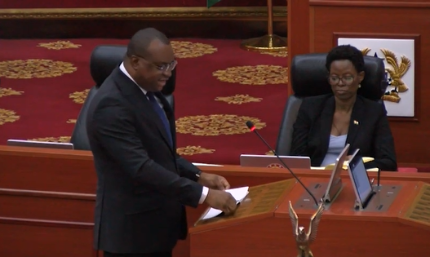

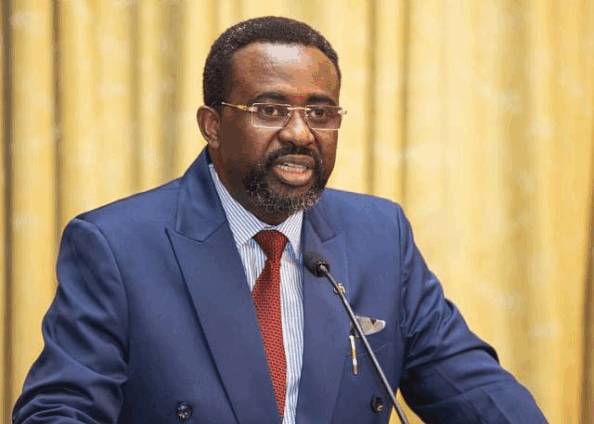

The event brought together key figures including Dr. Justice Srem-Sai, Deputy Attorney General and Deputy Minister for Justice, and Kyle Kelhofer, Senior Country Manager for Ghana and Liberia at the International Finance Corporation (IFC).

Dr. Srem-Sai praised the law as a powerful tool for rebuilding investor confidence and safeguarding jobs. He explained that CIRA provides a structured process for companies to reorganize their operations rather than face liquidation.

“When a company faces financial trouble, this law provides a clear path for recovery. It protects jobs and gives creditors confidence that their money won’t be lost entirely,” he noted.

A key feature of CIRA is its strict regulation of professionals who manage insolvency cases. Only certified and trained practitioners will now be allowed to oversee company restructurings, a move meant to eliminate fraudulent middlemen, popularly known as ‘goro boys.’

“This brings professionalism and transparency into the system,” Dr. Srem-Sai said. “No one can manage a collapsed business unless they are qualified and accountable.”

Mr. Kelhofer of the IFC also described the new framework as a “modern and predictable” one that will strengthen Ghana’s competitiveness and make it easier for businesses to access financing.

“The next important step is to make the law fully operational so that companies and lenders can begin to benefit from its provisions,” he said.

With the Corporate Insolvency and Restructuring Act now in place, Ghana is positioning itself as a leader in business recovery and financial reform in West Africa. The ORC and its partners have pledged to continue sensitizing the public and key stakeholders to ensure the law is effectively implemented.

Discover more from Hot Stories Ghana

Subscribe to get the latest posts sent to your email.