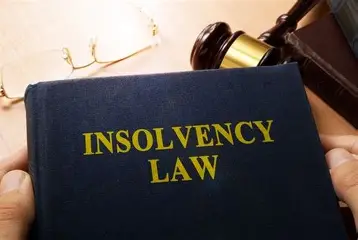

Total net credit flows in Ghana’s banking sector declined sharply by 39% year-on-year, reaching GH¢8.66 billion in August 2025, compared with GH¢14.25 billion recorded in the same period last year, according to the Bank of Ghana’s September 2025 Monetary Policy Report.

The contraction was largely attributed to reduced lending to the public sector, alongside a moderation in private sector credit as banks shifted focus toward Government and Bank of Ghana securities, reflecting a more cautious risk posture in the financial sector.

Private sector credit flows also declined to GH¢10.71 billion in August 2025, down from GH¢14.32 billion in August 2024. Despite the slowdown, the private sector remained the dominant beneficiary of total credit, accounting for 95.5% of all outstanding credit, up from 92.7% a year earlier.

By sectoral allocation, credit remained heavily concentrated in services (68.2%), commerce and finance (23.8%), and manufacturing (23.0%).

The total outstanding private sector credit stood at GH¢91.03 billion at end-August 2025, up from GH¢80.32 billion in the same month of 2024.

In real terms, private sector credit recorded a modest growth of 1.7%, compared to a 1.1% contraction during the corresponding period last year. The report also noted that growth in real sector credit remained slightly above trend, with the deviation widening marginally in August 2025.

The development underscores continued caution within the banking industry amid evolving macroeconomic conditions and ongoing portfolio adjustments by financial institutions.

Discover more from Hot Stories Ghana

Subscribe to get the latest posts sent to your email.